House prices in the UK have been on the rise for some time now, with some properties selling for 4 or 5 times their original sale price from just 20 years ago. People lucky enough to have purchased a house in the 1990s or before are enjoying unprecedented levels of equity in their property, while first-time buyers are being crushed under the weight of high deposits, high mortgage rates and inflation. But is this meteoric rise set to continue? Or is the old adage true: what goes up must come down? Let’s take a look at some expert UK house price predictions for the next 5 years.

What will happen to UK house prices in next 5 years?

The UK housing market has been subject to a multitude of factors that have resulted in volatile changes in recent times. One of the most significant developments was the surge in house prices during the COVID-19 pandemic, as many potential homebuyers postponed their purchasing plans. However, the current cost of living crisis is now putting significant pressure on household budgets, potentially making it more challenging for individuals to afford a home.

Factors influencing the UK housing market

Despite the ongoing challenges, the actual sale prices of houses have remained fairly steady. Nevertheless, the combination of inflation and higher mortgage interest rates has made potential buyers more cautious and less likely to commit to a purchase. This has had a modest effect on sale prices, with some sellers reducing their asking prices to attract buyers. However, the more patient sellers have maintained their original asking prices and still managed to make sales, suggesting that the issue may be limited to only the most motivated sellers.

Surge in house prices during the pandemic

The UK housing market experienced a significant surge in prices during the COVID-19 pandemic, as many potential homebuyers postponed their plans to purchase a property. This spike in demand, coupled with limited supply, led to a sharp increase in house prices across the country.

Cost of living crisis and household budgets

The current cost of living crisis is now putting significant pressure on household budgets, which could make it more difficult for people to afford to buy a home. With inflation and higher mortgage rates, potential buyers are becoming increasingly cautious and less likely to commit to a purchase, which could have a modest effect on sale prices.

Sale prices remaining steady despite inflation and higher mortgage rates

While inflation and higher mortgage interest rates have made potential buyers more cautious, the actual sale prices of houses have remained fairly steady. Some sellers have reduced their asking prices to attract buyers, but the more patient sellers have maintained their original asking prices and still made sales, suggesting that the issue may be limited to only the most motivated sellers.

Could these changes result in a housing market crash?

While the Nationwide has published data showing that house prices in the UK have fallen by 1.1% over the past year, this is the first time house prices have dropped in the last 3 years. Nonetheless, Nationwide has also predicted a 5% drop in UK house prices over the next 5 years. Similarly, Savills has anticipated a dip in house prices in 2023, although they also foresee a recovery by as soon as 2025.

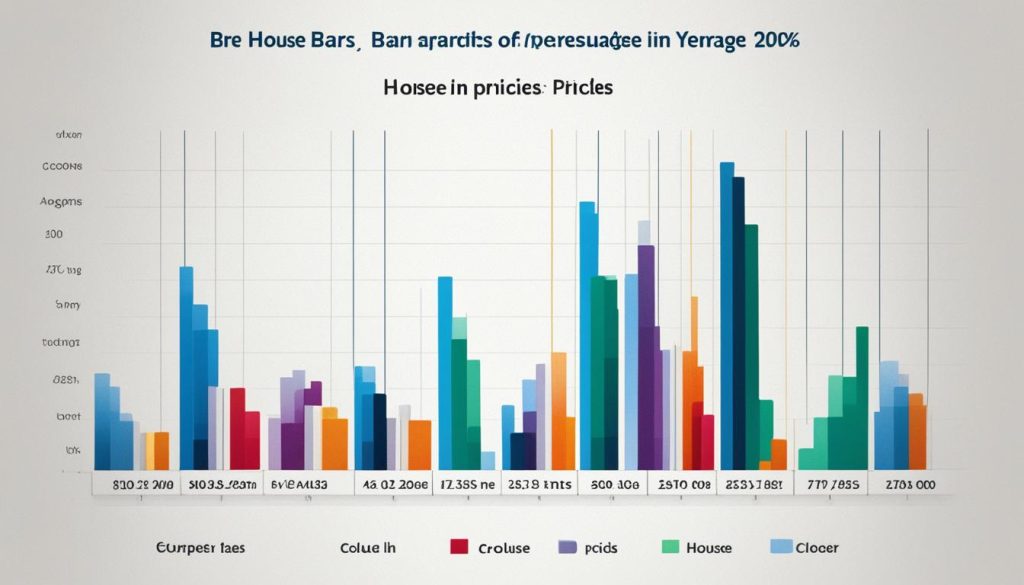

Savills’ predictions for different regions

According to Savills’ forecasts, the recovery in house prices will not be uniform across all regions in the UK. As the chart below illustrates, the East and South East regions are only expected to reach a 3% increase overall, while London is predicted to experience a more significant reduction of -1.7%.

| Region | Predicted House Price Change (%) |

|---|---|

| East | 3.0% |

| South East | 3.0% |

| London | -1.7% |

Have UK house prices fallen in 2023?

According to the Office for National Statistics, UK house prices rose by 1.7% from June 2022 to June 2023, when the average UK house was priced at £288,000. That’s a £5,000 jump from the previous year. But interestingly, it’s also £5,000 less than the highest price we saw in November 2022. However, this increase is not uniform in all areas of the UK – the North East saw prices rising by as much as 4.7%, while London prices actually went down by 0.6%.

Regional Variations in House Price Changes

This regional disparity is in line with Savills’ predictions that London will come out worse for housing prices compared with the rest of the UK. A slightly more modest growth than in recent years hardly constitutes a ‘crash’. London has had famously high house prices for some time, so with local government efforts like the Help to Buy scheme, the market has become a little more buyer-friendly.

London’s Unique Housing Market

The housing market in London has long been unique, with property values far exceeding the national average. However, the latest data suggests that the capital’s housing prices are starting to cool, while other regions of the UK are experiencing more robust house price predictions for next 5 years and uk property market forecast growth.

How much will house prices go up in the next 5 years?

As mentioned earlier with regards to UK house price predictions for the next 5 years, Savills does predict an overall rise in house prices, despite a slight dip in 2023. This dip has not been nearly as severe as predictions from this time last year, so it is important not to take these forecasts as gospel, even those from experts.

Savills’ Prime Capital Value Forecast

Interestingly, the Prime Capital Value Forecast from Savills shows even more robust growth in what they call the ‘prime market’, which comprises aspirational and desirable properties in the top 5% of the market by house price.

Predictions from various experts and sources

In addition to Savills’ forecasts, various other experts and sources have provided their own predictions for UK house price growth over the next 5 years. While these estimates may vary, they generally point towards a continued upward trend in residential property prices across the country, with some regional variations.

Impact of housing deficit and population growth

A key factor underpinning these predictions is the persistent housing deficit in the UK, combined with ongoing population growth. This mismatch between housing supply and demand is expected to maintain upward pressure on house prices, particularly in areas with the most acute shortages of new homes.

What’s changed in the housing market forecasts?

At the beginning of November last, we forecast that house prices would fall by an average of -3.0% in 2024 and that housing transactions would remain at around 1m for the year. However, our latest analysis suggests a more positive outlook for the UK property market, with revised forecasts reflecting changing mortgage rates and an improved economic outlook.

Revised forecasts due to changing mortgage rates

The volatility in mortgage rates and swap rates, which has been influenced by factors such as inflation and base rate uncertainty, has prompted us to revise our house price predictions for the coming years. While we had previously anticipated a more pronounced dip in prices, the market’s response to these economic conditions has been more resilient than expected.

Improved economic outlook and buyer confidence

The economic fundamentals that we expect to govern the market in the medium term have slightly improved. With Oxford Economics forecasting increased GDP growth and wage growth over the next five years, coupled with the prospect of steady cuts to the base rate starting in the second half of 2024, the potential for a progressive restoration of buying power and capacity for house price growth has become more promising.

Factors influencing house price predictions

Ongoing uncertainty around the pace of future base rate cuts, a relatively weak (though improved) outlook for economic growth in 2024 and the potential for a general election to pause the recovery means our expectation for house price predictions for the next 5 years has gone from low single-digit falls to low single-digit increases.

Uncertainty around base rate cuts

The Bank of England’s base rate has been a key factor in the UK’s property market performance, with increases in the base rate directly impacting mortgage costs and affordability for potential home buyers. Ongoing uncertainty around the timing and extent of future base rate cuts is creating some volatility in the market, making it challenging to forecast precisely how house prices will be affected in the coming years.

Economic growth outlook

The economic growth outlook for the UK in 2024 is relatively weak, though improved compared to previous forecasts. This could have a dampening effect on housing demand and activity, as consumers become more cautious about major purchases like buying a home during periods of economic uncertainty.

Potential impact of general election

With a general election looming, there is the potential for the housing market to be temporarily impacted as buyers and sellers adopt a ‘wait and see’ approach, pausing their purchasing decisions until the outcome of the election is known. However, most experts believe that the impact will be relatively short-lived, as the market quickly adjusts to the new political landscape.

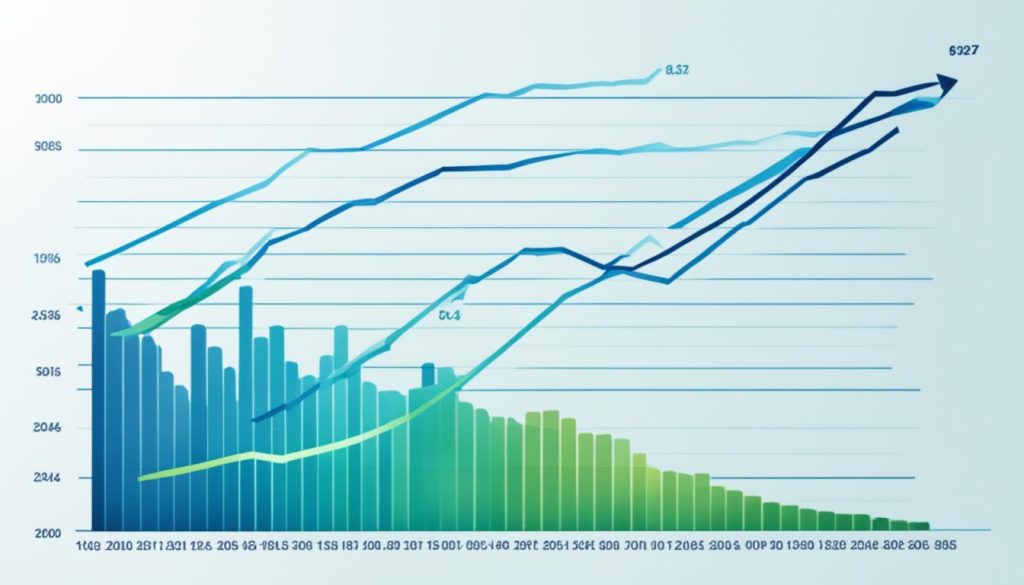

House Price Predictions for Next 5 Years

Our five-year UK forecast has therefore been nudged up from 17.9% to 21.6%. This updated five-year UK forecast from Savills reflects the latest trends and factors influencing the UK property market. The distribution of growth is also now expected to be slightly more even over the five-year period, rather than the previously anticipated dip at the start of the forecast period.

Distribution of growth over the forecast period

A strong economic performance in 2025 and 2026 will support buyer sentiment and drive continued house price growth across the UK. However, without the previously expected falls at the start of our forecast period, affordability constraints will become a factor earlier than we had previously anticipated.

Affordability constraints in London and the South East

The already stretched markets of London and the South East are likely to feel the impact of these affordability constraints more acutely. As house prices continue to rise, the ability for buyers to access and afford properties in these regions will become increasingly challenging. This could result in a more modest pace of growth compared to other areas of the country over the next five years.

Factors affecting housing market recovery

As the UK housing market navigates the challenges of the current economic landscape, there are several key factors that will influence the pace and trajectory of its recovery. The RICS survey provides valuable forward indicators that shed light on the dynamics at play.

Balance between new buyer enquiries and new property listings

A critical factor shaping the housing market’s recovery is the balance between new buyer enquiries and the volume of new property listings. If prospective home buyers remain cautious and new buyer enquiries falter, this could put downward pressure on house price predictions for the next 5 years and slow the market’s momentum. Conversely, if new property listings struggle to keep up with demand, it could help sustain residential property prices and support a more robust UK property market forecast.

Price cutting and seller expectations

Another key factor is the interplay between price cutting by sellers and the expectations of real estate valuations. Some homeowners may be willing to accept slightly lower prices to attract buyers in the current market, while others may hold firm on their home value estimations. The balance between these two approaches will be crucial in determining the overall housing market trends and the extent of future home values in the coming years.

We are increasingly confident that house price growth will be in positive territory at the end of 2024, but we expect price rises this year to be contained to 2.5%. The housing costs outlook and property investment analysis suggest a measured and gradual recovery, as the market navigates the complex interplay of these factors.

Volatility in mortgage rates and swap rates

The UK housing market has been grappling with significant volatility in mortgage rates and swap rates, which are closely tied to the overall economic outlook and monetary policy decisions. This volatility has had a profound impact on house price predictions for the next 5 years, as well as on the broader UK property market forecast.

Impact of inflation and base rate uncertainty

Inflation remains a persistent challenge, with the Bank of England struggling to bring it under control. This, in turn, has created uncertainty around future base rate adjustments, which are a crucial factor in real estate valuations and housing market trends. As the central bank navigates this delicate balance, mortgage rates have fluctuated, making it increasingly difficult for home value estimations and residential property prices to remain stable.

Volatile swap rates and market pricing of debt

Accordingly, swap rates – market pricing of debt over the medium term – remain volatile. Whilst the financial markets were pricing in the first base rate cuts to come in March 2024 at the start of the year, these swap rates have since risen again, responding to the continued uncertainty in the Middle East, and higher-than-expected US inflation data. This volatility has made it increasingly challenging for future home values and housing costs outlook to be accurately predicted, as the market pricing of debt remains in flux.

Political uncertainty and the general election

It is possible, therefore, that the upcoming general election could temporarily affect the UK housing market. With the odds firmly on an election towards the back end of the year, there is a risk that this will temper demand and activity in the autumn. However, polling suggests most buyers and sellers will have already factored in the prospect of change in government.

Potential impact of election on housing demand and activity

The prospect of a general election can introduce uncertainty into the housing market, as buyers and sellers may adopt a more cautious approach while waiting to see the outcome. This could temporarily dampen demand and slow down housing activity as the country heads to the polls. Nonetheless, the extent of this impact may be mitigated by the fact that most market participants have already anticipated the possibility of a government change.

Voter expectations of government change

According to the latest polling data, the majority of UK voters expect a change in government in the upcoming general election. This shift in voter sentiment could influence the housing market, with buyers and sellers anticipating potential policy changes that may affect the property sector. However, the long-term impact is likely to depend on the specific policies proposed by the incoming government and their effects on factors such as mortgage rates, housing affordability, and overall economic conditions.

Long-term outlook for the housing market

The economic fundamentals that we expect to govern the UK housing market in the medium term have slightly improved. Oxford Economics’ forecast for GDP growth over the next five years has increased from 7.2% to 8.9%, and their prediction for wage growth has risen from 15.8% to 16.4%. These factors, along with steady cuts to the base rate that are forecast to begin in the second half of 2024, will combine to produce a progressive restoration of buying power, opening up more capacity for house price growth.

Restoration of buying power

The steady cuts to the base rate, coupled with the improved GDP and wage growth projections, are expected to gradually restore buying power for prospective homeowners in the UK. This will provide more headroom for house prices to continue their upward trajectory, as demand is bolstered by increased affordability.

Progressive house price growth

With the restoration of buying power, the UK housing market is poised for progressive price growth over the coming years. While the market may experience some volatility in the short term, the long-term outlook points towards a steadier, more sustainable rate of house price appreciation, as the underlying economic fundamentals support a healthier and more balanced market.

Prime residential market forecasts

The prime residential market, comprising the most desirable and aspirational properties, is also expected to perform well in the long-term. Savills’ Prime Capital Value Forecast suggests robust growth in this segment of the market, reflecting the continued demand for high-end properties and the resilience of the prime housing sector within the broader UK real estate landscape.

FAQ

Could these changes result in a housing market crash?

Nationwide has published data showing that house prices in the UK have fallen by 1.1% over the past year, the first time house prices have dropped in the last 3 years. Nationwide has also predicted a 5% drop in house prices over the next 5 years. Savills also predicted a dip in house prices in 2023, although they also anticipate a recovery by as soon as 2025.

Have UK house prices fallen in 2023?

According to the Office for National Statistics, UK house prices rose by 1.7% from June 2022 to June 2023, when the average UK house was priced at £288,000. This increase is not uniform in all areas of the UK – the North East saw prices rising by as much as 4.7%, while London prices actually went down by 0.6%. This is in line with Savills’ predictions that London will come out worse for housing prices compared with the rest of the UK.

How much will house prices go up in the next 5 years?

Savills’ Prime Capital Value Forecast shows even more robust growth in the ‘prime market’, which comprises aspirational and desirable properties in the top 5% of the market by house price. The company has also nudged up its five-year UK forecast from 17.9% to 21.6%, though the distribution of growth is now expected to be slightly more even over the five-year period.

What’s changed in the housing market forecasts?

At the beginning of November last, Savills forecast that house prices would fall by an average of -3.0% in 2024 and that housing transactions would remain at around 1m for the year. However, their expectation for prices this year has now gone from low single-digit house price falls to low single-digit increases, and their five-year UK forecast has been nudged up from 17.9% to 21.6%.